The Weekly Wrapup is an analysis of the week's insurance tech news from the editors of Digital Insurance.

AXA and XL Group revealed this week

AXA's acquisition and its partnership illustrate the different mechanisms by which insurance companies' strategic moves are influenced by their digital transformation strategy. In announcing his company's acquisition, XL CEO Mike McGavick cited the "commitment to innovation that relevance in the global insurance industry requires;" in the ING partnership announcement; his counterpart Thomas Buberl of AXA called the move "another key step in AXA’s transformation, fully aligned with our payer-to-partner strategy."

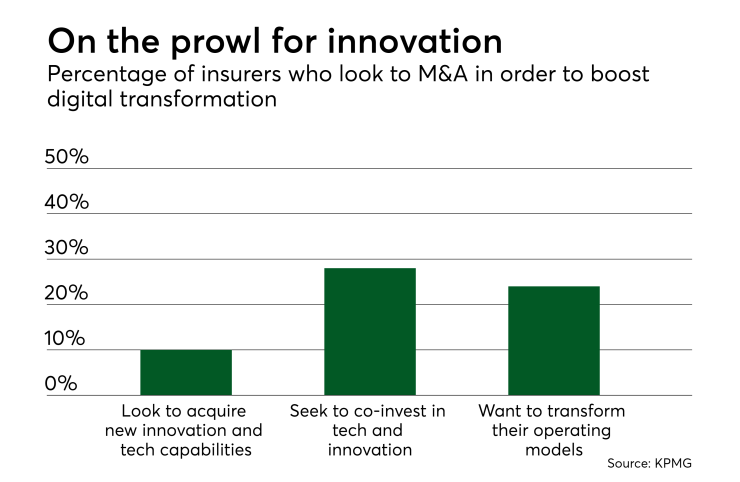

In a recent report, "Accelerated evolution: M&A, transformation and innovation in the insurance industry," KPMG examined the various ways in which insurance companies look to their peers and to new entrants for complementary digital innovation.

"The research confirms that the majority of insurance companies are actively seeking M&A, partnerships, and investment opportunities to transform their business and operating models, and to gain access to innovation capabilities and emerging technologies," write authors Laura Hay and Ram Menon, who interviewed 200 executives for the report.

However, they continue, this isn't a bolt-on solution. Insurance companies will have to continuously evaluate their deal strategy in order to stay on top of changing market trends.

"The successful insurance organizations of the future will be the ones that are already thinking beyond traditional M&A to execute transformational deals that satisfy both the evolving needs of their customer base, and demands from shareholders and investors for strategic capital deployment to enhance enterprise value," the authors caution.

KPMG offers four tips for ensurers to ensure that their M&A and partnership strategy effectively serves the needs of a changing sector:

1. Redefine deal success. "To truly drive transformation and capture innovation across the enterprise, insurers must align the capabilities of their corporate strategy, M&A and corporate development, and innovation teams — around a shared vision for the future for the enterprise and its core business segments," the authors say.

2. Maximize deal value of divestitures. "As the industry transforms, insurers are actively revaluating their portfolio of businesses, rationalizing their global footprint and strategically repositioning some of their legacy business segments," KPMG writes. "If the decision is made to divest a business or blocks of businesses, the insurer’s deal strategy should address how to package, separate and deliver the business as attractively as possible to a potential buyer."

3. Stand up an inorganic innovation engine. "With the abundance of capital available, the strongest start-ups have access to a diverse selection of investors. Insurers must determine what value they can offer to potential portfolio companies, outside of capital, such as specialized domain expertise, access to customers, commercial partnerships, and testing environment for proofs of concepts, to compete for access to the best deals," the report says.

4. Remember it's not one-and-done. "Insurers should plan for solving multiple, complex, inter-dependent problems across the enterprise while operating within a dynamic and hyper-competitive industry environment. Deal success in the new deal environment will require insurers to adopt a holistic framework to assess strategic fit, establish longer-term synergies case and design integration plans," KPMG concludes.