It can be hard for P&C and Life/Annuity insurers to sort the hype from reality when it comes to areas like social media, mobile, analytics, big data, cloud, and digital capabilities.

Recently, Novarica released its “Hot Topics” report which is designed to show adoption rates and provide insurance carriers with insights on six “hot topic” areas: social media, mobile, analytics, big data, cloud and digital. This report is based on a snap poll conducted in November 2014 of 90 members of the

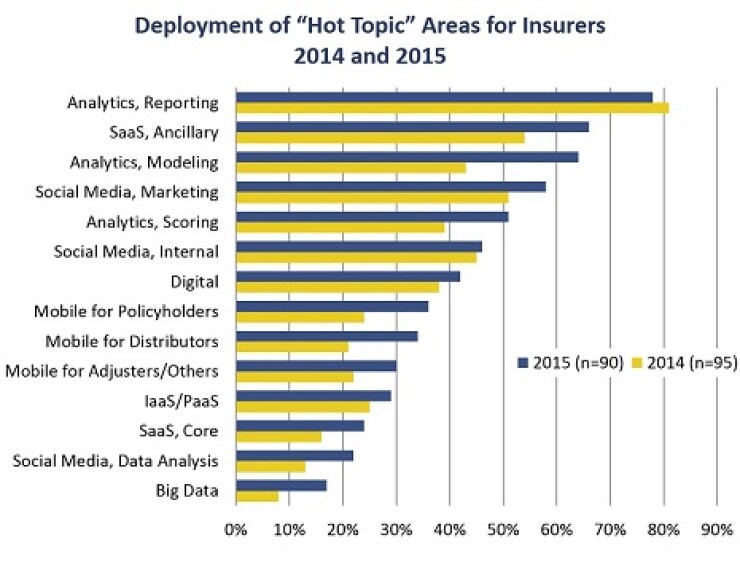

As you can see from the chart above, deployment rates have grown in the year since Novarica’s last study on these topics. Big data deployment rates, while still under 20 percent, have more than doubled over the past year, and mobile has increased in every category, with the largest percentage increase in deployment for policyholders. Analytics usage in modeling has increased by nearly a third, but there’s still a persistent gap in analytics usage between large and small insurers. Some other relevant statistics of note include:

- 40 percent of respondents have deployed social media in some areas of marketing

- 27 percent of respondents have active or planned mobile pilot projects for distributers

- 44 percent of respondents have deployed analytics to provide real-time scoring in some areas

- 16 percent of respondents have active or planned pilot big data projects

- 18 percent of respondents have deployed in some areas SaaS for core applications

- 72 percent of respondents said Agent e-business was part of their digital strategy

- 67 percent of respondents have no formal ROI for analytics already deployed but its value is widely recognized

- 10 percent of respondents have well deployed and widely understood mobile plans

- 29 percent of respondents have deployed digital or digital strategy in some areas

- 36 percent still trying to understand the value of social media data analysis

The six “hot topics” included in this report share two main characteristics. First, they enable potentially disruptive changes in one of more areas of the insurance value chain or traditional company operating models. Secondly, they are discussed more than they are embraced or understood.

As we noted last year, today’s “Hot Topics” are tomorrow’s basic capabilities. Increased, but still uneven, deployment rates in mobile, social, big data, and other areas indicate this evolution is continuing, and that some companies are evolving faster than others.

This blog entry has been reprinted with permission.

Readers are encouraged to respond using the “Add Your Comments” box below.

The opinions posted in this blog do not necessarily reflect those of Insurance Networking News or SourceMedia.