Soon, the executive of a major healthcare institution predicts, it will be possible to learn more about a patient’s health status from data gathered by wearable devices than a physical exam.

The technology underlying this is known as “deep learning.” It is one of a constellation of intelligent machine activities that includes artificial intelligence, machine learning and neural networks that have interesting implications for the insurance industry.

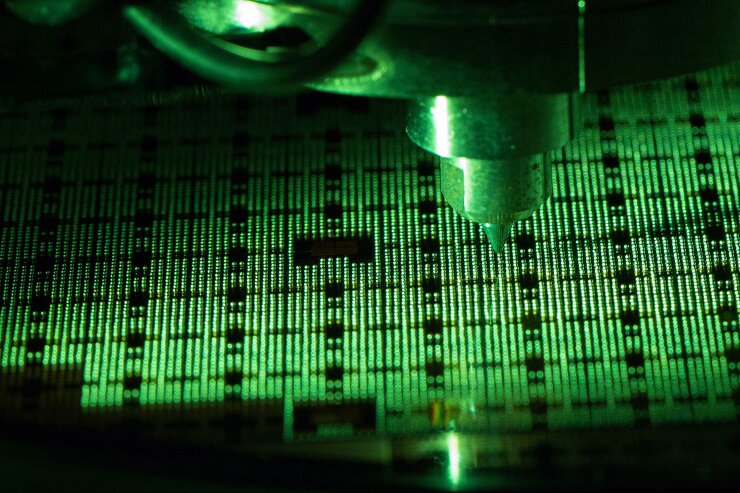

Deep learning “is a type of machine learning that uses multi-layered neural networks, this means, that machines can now learn new things as they operate, such as how to recognize images,” Sameer Mahajan of GSLabs explains in a recent

Mahajan suggests that deep learning, which works with unstructured information such as images and pictures, “has already started to disrupt the insurance industry.” With all the various pieces of information they are now able to collect, “insurers can now use deep learning not only to assess text and images, but to recognize patterns and draw conclusions from those patterns.” For example, Mahajan posits that these ever-smarter algorithms “could accurately predict whether someone will end up in a hospital soon.”

As Mahajan explains: “It is now possible to… collect and crunch a lot of data like continuous heartbeat, pulse rate, facial expressions indicating potential medical conditions, etc. Simple wearables can now give real time analysis of one’s nightly sleeping pattern. The health conditions due to sleep deprivation can thus be monitored and even prevented real time. The sugar level in chronic diabetes patients can not only be monitored, but also controlled [by] automatically administering the corresponding insulin dosage [to avoid] any calamity.”

Health insurers aren’t the only ones who can benefit from the predictive power of deep learning. Property and casualty carriers are also looking into the possibilities. AXA, for example, is piloting a deep learning project to predict automobile accidents.

Deep learning – made possible through Google’s TensorFlow machine learning engine – helped AXA adjusters identify those clients at high risk of causing major accidents and adjust its policy pricing accordingly. The team fed 70 different variables into the Google algorithm, including driver age, address, annual insurance premium and age of vehicle. The results reported were 78% accurate.

Per the Google case study, “This improvement could give AXA a significant advantage for optimizing insurance cost and pricing, in addition to the possibility of creating new insurance services such as real-time pricing at point of sale.”

We’re still in the very early, learning stages for deep learning and related machine learning technologies. But for once the insurance industry may find itself, as Forbes contributor Bernard Marr puts it, on “the cutting edge of the cutting edge.”