Insurers are increasingly interested in ways to make better use of data in their daily business decisions.

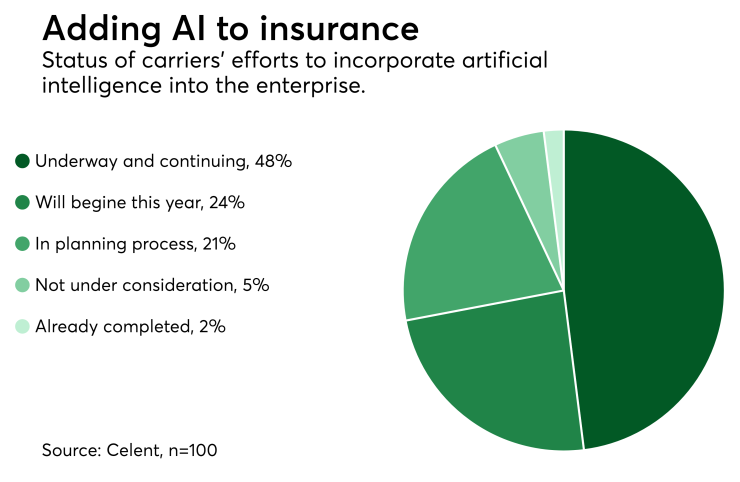

Indeed, almost half of the CIOs we have surveyed this year mentioned that they are currently working on analytics including AI, machine learning, etc. It is also interesting to observe that a minority of insurers (5%) is not working on this topic currently.

Our recent Model Insurer program helped us better understand what insurers are doing around data, analytics and AI. The awards’ winners in this category have leveraged analytics and AI to improve various facets of their business. Cattolica Assicurazioni in Italy developed an Automatic Damage Estimation (ADE) tool allowing for automatic car's damage estimation trough processing claims photos by an artificial intelligence engine. IndiaFirst Life Insurance in India worked on surrender prediction but the insurer also developed a product recommendations engine and a cross-sell model. Markerstudy Group in the UK implemented an AI Platform for customer acquisition and retention. Munich Re America worked on a Smart Mobility Loss Analysis Tool to identify the core causes of loss of road crashes through both predictive and prescribed analytic techniques and to address the loss drivers through technology and risk management solutions. Taikang Insurance Group in China developed a Customer Identity Verification Platform (CIVP) leveraging biological feature-based customer identity verification platform that supports decision-making processes (underwriting, claims, etc.). For more details on these initiatives, we recommend the reading of the following report we published in April:

What we find interesting when we reviewed all the recent insurers’ initiatives that have an AI components is the growing interest of insurers for the development approach. Indeed, around half of the insurers who have submitted a nomination to Celent for this year Model Insurance program in the data, analytics and AI category have decided to develop their own tool. In addition, we see an increasing number of firms leveraging open source tools such as TensorFlow the Google AI engine.

Overall, we think there are important considerations for insurers desiring to invest in AI through development leveraging open source tools or programming languages. My colleague Craig Beattie and I are currently working on a model that should help insurers capture the main factors at play when planning an investment in AI. For instance, what kind of resources will be needed based on the approach chosen? Do they own the required skills internally or do they need to find them externally to their firm? How should they organize internally to promote collaboration and innovation in the AI space? Can they leverage components offered on the market or are they better off picking low cost or free tools?

We will try to provide our view on all these questions and I am sure this piece of research will trigger interesting discussion among our subscription clients.

This blog entry has been reprinted with permission