Wildfire presents a significant challenge to

The article explores nine key takeaways about the market, through data and visualizations. We highlight two of them with the charts below (to read about all nine,

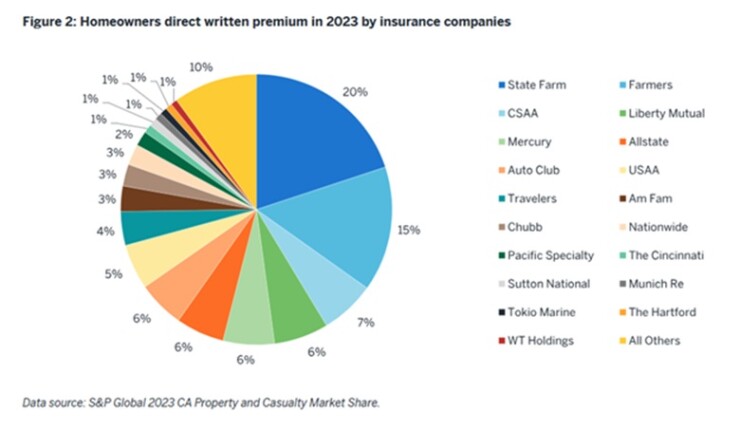

Key takeaway: California's homeowners insurance market is concentrated among a few major insurers.

The CA homeowners insurance market is concentrated among a few major insurers. Excluding the FAIR Plan, the top five insurers account for 54% of the market share in 2023 direct written premium. This concentration, coupled with the exodus of carriers outlined above, increases strain on the supply of coverage available to consumers, especially following large loss events like wildfires. (See Figure 2).

Key takeaway: Average CA homeowners insurance premium is below the countrywide average

In 2021, the average homeowners insurance premium (HO-3) in California ($1,403) was below the national mean ($1,411). Compared to states known for frequent catastrophe events, such as Florida ($2,437), Louisiana ($2,259), and Texas ($2,146), CA's average premium was also markedly lower. (See Figure 4).

Key takeaway: Los Angeles fires is likely one of the costliest events in California history.

The Los Angeles fires will certainly be considered a major catastrophe event in 2025.

Based on the latest CAL FIRE Top 20

Due to the close proximity and similar start times of the Palisades Fire and Eaton Fire, along with several smaller fires such as the Kenneth Fire, Hurst Fire,

Big picture impact

Wildfires and other natural catastrophes impact the cost of insurance and the overall cost of living, which illustrates one way in which the cost of climate change is being incorporated into the economy. The insurance market is playing its role in mitigating the financial burden caused by natural disasters, but it also requires a sustainable and healthy economic and regulatory environment to function effectively. As the aftermath of recent events is addressed, valuable insights are being gained to improve wildfire mitigation techniques and methods to prevent or minimize damage in future occurrences.

See the