As of this writing, the Astros hold a five-game lead in the AL West. But not long ago, the outlook wasn’t so rosy for Houston’s boys of summer. In 2013, the Astros finished last place in their division posting a record of 51-111. It was a franchise worst.

Yet despite the Astros terrible performance, Sports Illustrated ran a cover story the next year, predicting the Astros would win the 2017 World Series. It sounded crazy, even to industry insiders. Why would a major media outlet like Sports Illustrated put its reputation on the line and pick the Astros to win the World Series just three years after the team turned in its worst season ever? What changed?

In a word, everything.

In the 2000s, many MLB teams started to dabble with the “Moneyball” concept. But the Astros saw what was ahead and charted a trajectory beyond Moneyball toward a data-focused future. They hired the best analytics consultants, created a comprehensive data platform and made the platform available to everyone in the organization — players, coaches, the head office, even treatment staff. They wanted to empower every person, in every aspect of their operation, with data – big and small – to inform and improve decision-making.

Do you know which team won the 2017 World Series? You guessed it. The Houston Astros. And they did it by going all-in on data and constantly adapting their system based on the lessons they learned along the way.

Keeping Score: Traditional Claims vs. Connected Claims

The auto insurance industry currently faces a moment not unlike the one the Astros faced when they charted a course toward a brighter future.

Mobile, AI and the Internet of Things (IoT) are radically changing the way businesses interact with consumers – and this is certainly true in insurance. The convergence of these technologies offers tremendous opportunities for a transformed industry environment that offers greater efficiency, increased revenue, and a significantly better consumer experience.

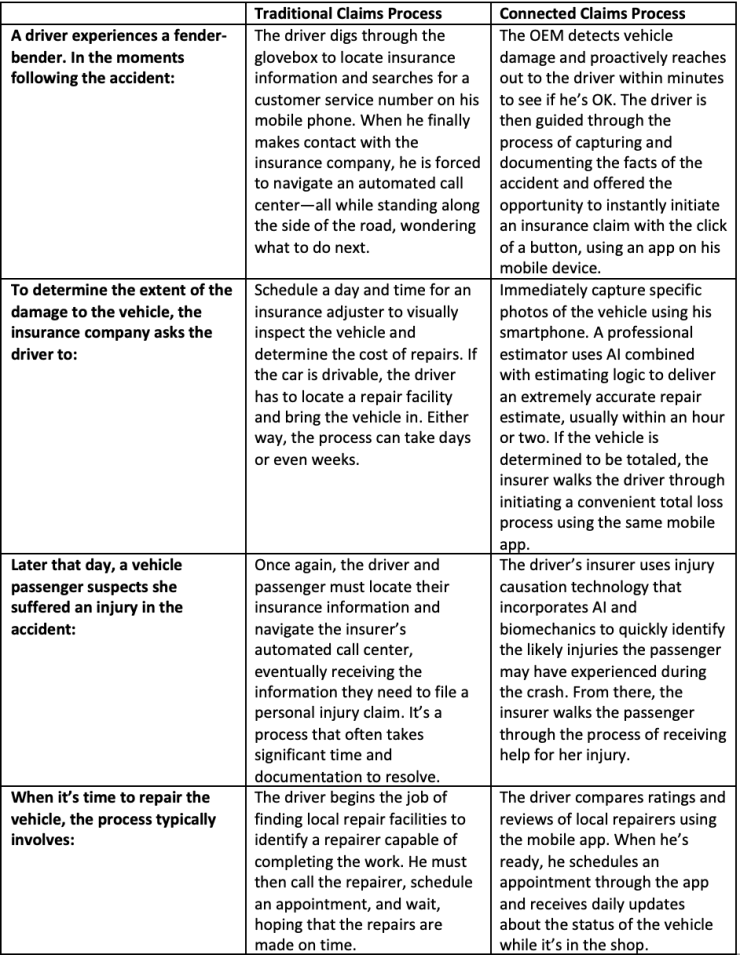

Although the combined use of mobile, AI and IoT impacts the entire auto industry, its benefits are particularly apparent in the claims process. A technology-driven claims process — the connected claims process — offers consumers a much better experience than the traditional claims process.

Take a look at a side-by-side comparison of the two claims processes to see what I mean:

The connected claims process is a game-changer for consumers, insurers and other industry players. For the first time, consumers can enjoy greater control and a hassle-free insurance experience, largely due to the convergence of mobile, IoT, and AI.

We’re in the Second Inning

Unlike the Astros, insurance providers don’t have to wait three years to enjoy the payoff of going all-in on mobile, AI and IoT. The connected claims process is enabled by a mature, single platform that combines the use of these technologies and brings insurers, OEMs and other industry players together to create a better, unified consumer experience.

And some insurers are already relying on this platform to do just that:

● Photo estimating with AI improves accuracy and productivity. The technologies that create and enhance the connected claims process are quickly becoming standard practice throughout the industry. At CCC, photo estimating with AI — a process that improves estimators’ productivity by 25% — is currently used for more than 15% of repairable vehicle estimates. In the past nine months alone, the number of mobile-based photo estimates increased 400%.

● Telematics-enabled claims reduce cycle times. By 2020, analyst projections indicate there will be more than 50 million telematically enabled vehicles on the road—and that’s a conservative estimate. When you consider that the connected claims process can reduce cycle times by six days in some scenarios, it’s easy to see how telematically enabled vehicles are redefining the claims process for consumers and insurers.

But even though the current use of mobile, AI and IoT is impressive, we’re only in the second inning of connected claims technology. As the technology continues to advance, the amount of available data will continue to grow, and the industry will develop new algorithms capable of using the telematics data in even more exciting ways.

So, as an insurer, what’s the most important lesson you can learn from the Houston Astros? That’s simple: Now is the time to go all-in on connected claims. By wholeheartedly embracing the technology that is reshaping the vehicle ownership lifecycle and iterating on processes across your organization, you can create an organizational environment that’s ready to win…just like the Astros.