Insurance is a complex industry, and companies are always looking for new ways to improve their products and services to serve customers better. Visual intelligence is an emerging technology that insurance companies have begun using to eliminate bottlenecks and automate tasks, especially in

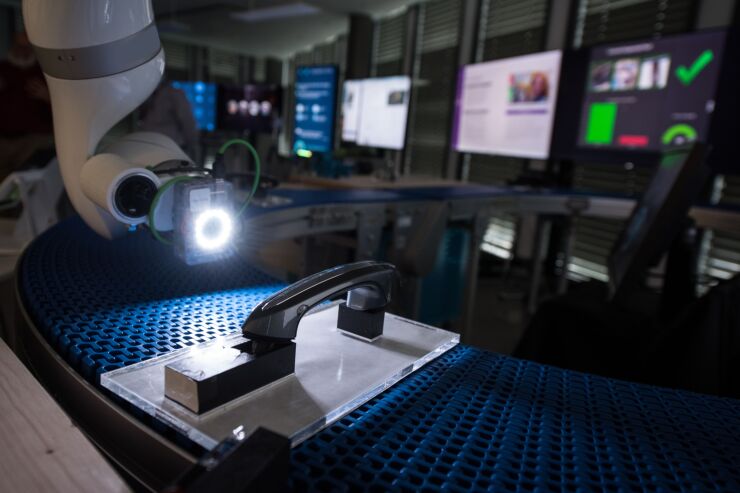

Visual intelligence is a technology based on computer vision algorithms capable of identifying and categorizing objects or attributes within digital images or videos. In the home and motor vehicle insurance industry, visual evidence plays a crucial role in claims processing. When incorporated into claims management software, it can analyze an image and search for similar images, recognize the texture of the damage (for example, metal, carpet, brick walls, etc.).

This allows an insurer to remotely identify the cause of property damage, for example, a flood or burst pipe, or which parts of a vehicle need to be fixed or replaced, and calculate the cost to repair in minutes instead of days.

Furthermore, claims processing has always been a key area for insurance companies to meet and exceed customers’ expectations. Visual intelligence can help automate many of the repetitive steps in the claims process, saving assessors time so they can focus on more important tasks and resolve customers’ needs faster. These improvements in operational efficiencies result in a better experience overall for the customer.

Over the past few years, the insurance industry has undergone a major

Here’s a deeper look at how visual intelligence helps insurers eliminate and automate many manual steps throughout the claims life cycle.

1. Reducing claims processing times and costs

Processing a claim is known to be a time-consuming task that has historically required a significant amount of human intervention. Claimants typically need to call their insurance company and then wait on hold or for a callback, before sending over personal information and eventually relaying the details of the incident. When too much time passes between the incident and the report, there’s a good chance that stress and possible trauma may distort the events as well.

Visual intelligence can help reduce processing times from days to minutes. Claimants can submit damage evidence digitally, and advanced AI algorithms have the ability to identify patterns in photos or videos of the damage, check for signs of

According to Accenture, a majority of policyholders view settlement speed as the

2. Reducing insurance fraud

Fraud is one of the leading threats to insurance companies. It can negatively affect policyholders as well when it occurs too frequently. Insurers need to charge higher premiums to recover their losses and the legal costs of pursuing fraud cases.

Visual intelligence is playing a key role in helping insurers reduce fraud. In the underwriting stage, for instance, advanced analytics from devices such as built-in sensors can help identify signs of fraud. The technology can identify abnormal behavioral patterns or inflated claims by quickly comparing an incident to other cases and assessing whether or not the damage lines up appropriately with the amount that is being requested.

Any incident involving vehicle or property damage can be a dramatic experience. The affected parties are not always in a calm state of mind while gathering photo or video evidence. Visual intelligence applications can play an important role here too, helping guide the policyholder through the evidence-gathering process. AI-driven applications can help claimants collect credible, accurate evidence, eliminating opportunities to exaggerate or tamper with it before submission.

Finally, when combined with

3. Enabling a better customer experience

An insurance transaction is based on a relationship of trust between the insurer and the policyholder. And until recently, this trust was established through face-to-face interactions throughout the claims process.

However, consumers nowadays prefer a digital-first claims process to resolve incidents in the quickest way possible. The social changes brought on by COVID-19 have also increased the demand for solutions that don’t require an in-person presence.

According to McKinsey, a digital claims process can drive a

Determining the cause and severity of damage and identifying potential fraudulent cases are important ways visual intelligence is having an impact on the insurance industry and improving the experience for insurers and policyholders. There’s no doubt that visual intelligence technology will continue to advance, resulting in even more exciting solutions for the insurance industry in the near future.