In a December 18 U.S. Senate Budget Committee hearing, finance professors and senators aired contrasting views of the extent of non-renewals and

Robert Hartwig, clinical associate professor of finance, in the Darla Moore School of Business at the University of South Carolina, testified to the committee that litigation against insurers, rather than the effects of climate change, are the main cause of rate increases and non-renewals. "The insurance industry is not in the midst of a climate driven crisis, nor is it about to fall," he said.

Hartwig added that the increases in U.S. non-renewal rates are driven mostly by Florida and

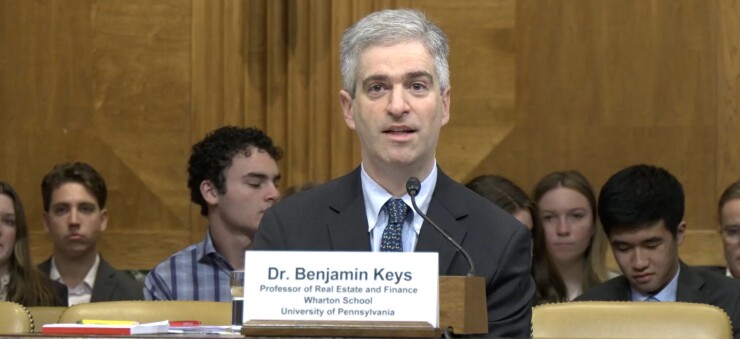

Sen. Sheldon Whitehouse (D-R.I.), current chair of the committee until the Senate switches to Republican control in the new year, presented charts of data showing a correlation between climate change and non-renewal rates rising at the same time. Benjamin Keys, professor of real estate and finance in the Wharton School at the University of Pennsylvania, responding to Sen. Whitehouse, said looking at the data at a county level reinforces this correlation.

"It's very much concentrated in the highest climate risk areas, especially along the coasts, but also in areas as you [Sen. Whitehouse] mentioned, like in Oklahoma and parts of New Mexico," Keys said.

Hartwig, responding to questions from Sen. Charles Grassley (R-Iowa), ranking member of the committee, added that reforms by individual state regulators were bringing insurance carriers back into markets they had left, notably in Florida.

Also in the hearing, Ernest Shaghalian Jr., an agent at Butler & Messier Inc. Insurance in Pawtucket, R.I., told Sen. Whitehouse, "The problem is with the consumers that are being forced into risk pools, being forced into the surplus lines markets, being forced to pay more money for the insurance and having less availability of optional coverages."

Sen. Tim Kaine (D-Virginia) spoke in the hearing about rising rates and non-renewals effect on the mortgage and housing markets. Parts of Virginia along the coast are seeing flooding more than they did 10 years ago, and have had non-renewals increase, Sen. Kaine said. After

Following the hearing, the National Association of Mutual Insurance Companies (NAMIC) issued a press release criticizing the conduct of the Senate Budget Committee hearing. In the release, Jimi Grande, senior vice president of federal and political affairs at NAMIC, stated, "Days away from a government shutdown, the Senate Budget Committee has failed to produce a federal budget while every second government debt compounds on the backs of taxpayers. Instead of an emergency session on this, the Senate Budget Committee chooses to manufacture an insurance crisis singularly driven by climate change to score political points."

The NAMIC release also pointed to inflation and litigation as causes of home insurance non-renewals and rate increases.