Despite a big dip in March and April, insurtech funding in the first half of 2020 is only 2% behind last year, according to recently released research from Deloitte.

Funding in the first half of 2020 reached $2.19 billion, compared to $2.24 billion in the first half of 2019, the "COVID-19 pandemic shifts InsurTech investment priorities" report says, citing data from Venture Scanner.

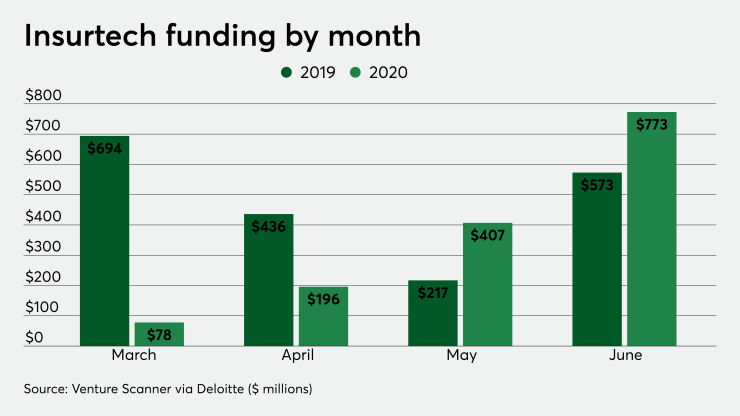

But it's a tale of a furious comeback from the depths of the early COVID-19 pandemic in the U.S. In March 2019, insurtech funding reached $694 million. This year, there was only $78 million reported, lower than the same month in 2016, 2017, and 2018. April 2020's $196 million was less than half of what was reported in the same month in 2019.

May 2020, however, nearly doubled May 2019 ($407 million to $217 million) and June 2020 ($773 million) was $200 million above June 2019.

Activity continues to indicate that winners of the insurtech wave that began in 2016 and 2017 are largely beneficiaries of the big investment rounds, though. The company says that only 38 new insurtech entities have launched since 2018, compared to 124 in 2017 alone and a record of 215 in 2016. Deloitte writes: "Most of the funding was concentrated among the top 10 InsurTechs, which accounted for nearly two-thirds of all dollars invested in the first half—with the top four dominating by drawing 44% of the total.

"Such concentration is not new (in the first half of 2019, the top 10 accounted for 53% of all funding), but it is accelerating, a phenomenon becoming more pronounced over the past few years, and described by more than one investor group we interviewed as evidence of an ongoing 'flight to quality,'" the company continues. Deloitte says that Sam Friedman, Mark Purwowitz and Nigel Walsh were co-authors on the report with help from Prachi Ashani, Gaurav Vajratkar, Nikhil Gokhale and Michelle Canaan. "The prevailing trend of investors and end-users focusing on InsurTechs that appear more likely to make a market impact sooner rather than later is likely being accentuated by rising demand for those ready to deploy and that meet recently emerging needs, particularly related to the pandemic."

As the industry looks to move forward post-coronavirus, Deloitte expects insurers to seek insurtech partners that can "help accelerate virtual interactions in sales and claims, as well as reduce expenses.

"Attention is also expected to shift toward InsurTechs that can provide insurers with more comprehensive, holistic offerings rather than single-point solutions that need to be integrated by the end-user," the report says.