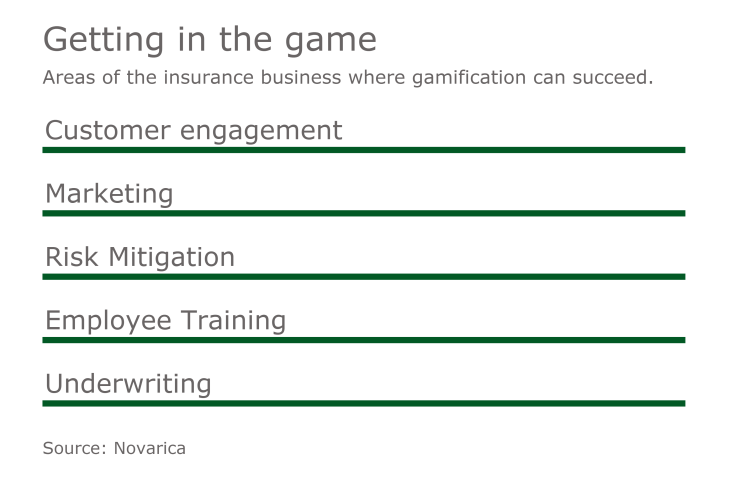

Investment in gamification can offer insurance companies the tools to improve customer engagement, employee training, and risk mitigation, according to a new executive brief by Novarica.

The report, “Gamification and Insurance: Application and Use Cases”, finds investing in elements of game playing can help carriers round out digital offerings by creating incentives that lower risky behavior. Gamified products frequently feature point scoring and rewards for leveling up or completing challenges, the firm said.

“Gamification allows customers to see insurance agents and carriers as worth interacting with,” says Tom Benton, Novarica’s vice president and the brief’s author. “Companies usually interact when something bad happens; gamification helps carriers interact in a positive light.”

Gamification is used extensively in other industries as a form of marketing, according to the report. However, it has a number of applications within insurance that can result in greater customer loyalty and risk mitigation, Benton adds.

Many companies in the retail space are beginning to design entire products around gamification, the study says—citing wearable manufacturers Garmin and Fitbit’s efforts to induce competition on social media using mobile applications.

A similar trend is occurring in insurance. While gamifying remains relatively new to the industry, a number of carriers are using gamification tactics to improve real-time interaction with millennials, train internal staff, and market new products.

Examples around insurance of gamification to date include: Allstate’s “PII Protectors” game, which coaches employees on privacy security and compliance; State Farm’s Drive Safe & Save usage-based insurance offering, and John Hancock’s Vitality program. Other carriers are involved in gamification strategies as well, Novarica notes.

“We see insurers using gamification in the future for general customer engagement,” says Benton. “But in terms of specifics, the rise of virtual reality could add gamification elements we haven’t seen yet.”