Nearly a third of consumers would be open to purchasing insurance from big tech firms such as Amazon and Apple, according to the new World Insurance Report 2018 from Capgemini in collaboration with Efma.

This is a sharp increase compared to the last three years, up 69% since 2015. According to Seth Rachlin, EVP and P&C insurance lead at Capgemini, this rate of change highlights the continuing divide in expectations around customer experience between the younger, tech-savvy generation and the rest of the population.

While there is good news in the sense that overall policyholder satisfaction is a bit better than last year, he explains, a divide persists. The insurance industry needs to recognize the report’s finding as being indicative of customers' decreased brand loyalty, he prescribes.

"Insurers are forced to deal with and operate for two very different kinds of customers, while providing a holistic experience across populations," Rachlin says. “I was talking to a leader at one of the big Tier 1 insurers in the U.S. and she described it perfectly, saying the mission for the insurance company is less about reinventing its own value chain and more about how do you become part of everybody’s else’s value chain."

However, there remains an open question as to whether big tech firms will want to be risk-owning, risk-bearing entities, or whether they will see insurance as another product they can distribute and insurers will effectively become their partners.

“From a market perspective, there is a lot of hype and buzz right now within insurance around digital and insurtech and around disruption and startups. There is a broader recognition that distribution has fundamentally changed, with big tech companies are players and other financial services entities in the mix,” Rachlin says. “Digital technology should enable an open platform for insurance distribution where all partnership and affiliations drive the product to market to tech-savvy, Gen Y customers.”

In response to these challenges, the report found that leading North American insurers are investing significantly in microservice enablements of their core transactional platforms, using APIs to expose the core functions of various claim activities.

“The impetus to do that is to have a more nimble [enterprise that] is better able to experiment with all of these new distribution vehicles and potential partnerships, whether that is becoming part of an online banking experience or a mortgage experience,” says Rachlin. “All of those potential connection points can become enabled if they have the technology platform that makes it possible.”

Another important report finding was around the extent to which changes in digital operating models are becoming increasingly necessary.

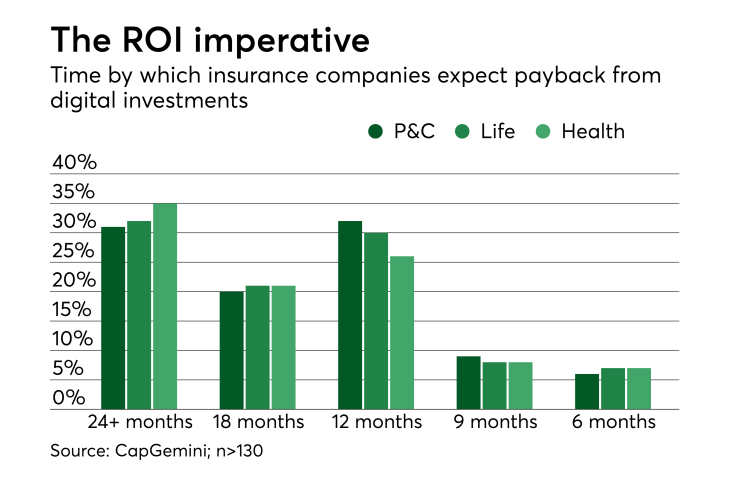

“In terms of the ROI for digital initiatives and projects, we’ve moved from a place where everything was viewed in a five-year model, and now it's a 12- to 24-month horizon, which is a sea change,” he says. “As a result, the operating models of the IT organizations at insurance companies are pivoting towards faster, more agile delivery.”

This, however, is hard work for most organizations, requiring different talent skills and going beyond a simple commitment to change. “Everybody’s looking to figure out how to scale agile within their environment,” he says. “But I think the hardest part is the people -- how to attract the best talent from the marketplace who want to truly innovate. That will be a persistent challenge.”