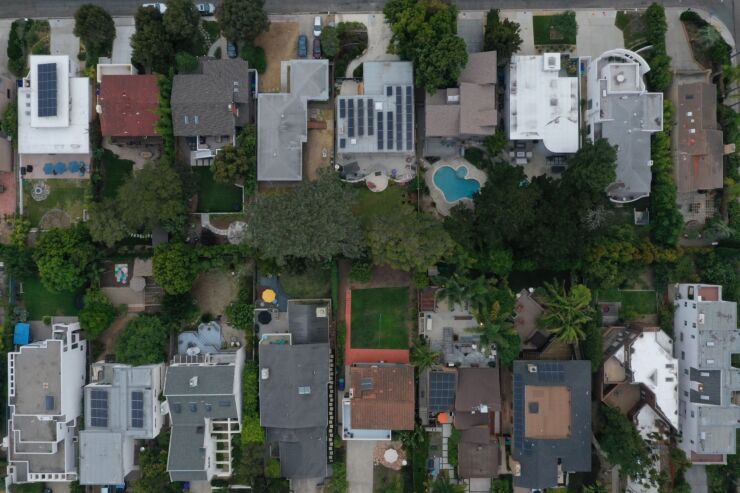

In a sample of one million residential U.S. properties using AI and aerial imagery, ZestyAI found that 45% are multi-structure properties. This is a significant finding, according to the insurtech, because of the common challenge that insurers face in identifying and assessing risk for properties with multiple structures.

The data reveals that 31% of properties have two structures, 11% have three and 4% have four or more. Cases where a property has three or four structures can be particularly challenging, according to ZestyAI research, even when the insurer has identified the other structures at a property.

Attila Toth, founder and CEO of ZestyAI, says that advanced analytics can help insurers better identify these additional structures, helping to close the potential gap for those underinsured properties.

"Coverage B, which protects 'other structures' on a property not attached to the primary dwelling, is notoriously challenging to get right. Insurers often rely on limited, outdated property records or self-reported information, which can be incomplete or inaccurate, failing to account for changes or additions to these structures," said Toth, in an email to Digital Insurance.

"Technology provides a powerful solution. Innovations like aerial imagery and computer vision enable accurate identification of all secondary structures on a property. By integrating additional data from diverse sources and applying advanced AI models, insurers can assess these structures' size, condition and potential risks, including degradation and exposure to natural catastrophes. This comprehensive approach delivers a deeper, more accurate understanding of a property's full risk profile, resulting in more precise coverage and fairer pricing," Toth said.