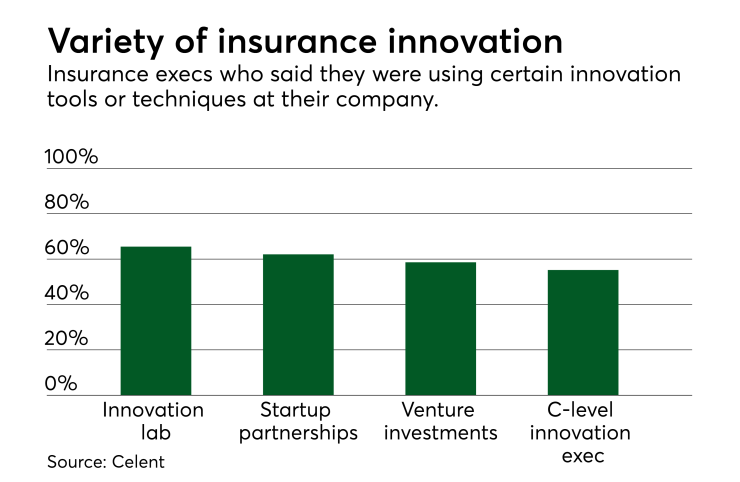

Venture investment in insurtech companies by carriers is growing across the industry. A Celent survey found 58.6% of insurers are doing some amount of it. But as these arms grow in financial size and stature, they can take on other tasks as well.

That's what's going on at New York Life, which has been running a venture unit since 2012. Headed by Joel Albarella, New York Life Ventures has invested more than $200 million in 29 startups over the past several years, it announced in January. The company has also performed approximately 100 proofs of concept with emerging technologies.

"We're a pretty strong example of driving innovation, and we have the results to show for it," Albarella says. "We don't have a mandate to invest. The investing component is an opportunity for us to build a trusted network to add value to NYL across the value chain."

As innovation and digitalization have become bigger trends in the insurance industry, as well as startup investment, NYL Ventures has expanded its purview. The same Celent survey found that 65.5% of insurers are running innovation labs, and 62.1% are entering partnerships if not outright investing. These all fall under the venture' unit's umbrella, Albarella explains, outlining four main charges his sector is responsible for:

- Invest in early-stage startups and funds

- Bring new tech back into the business, showing business value from early-stage companies

- Run a research and development lab

- Manage innovation services and training programs for the company

"When we started in 2012, insurtech wasn't even a thing. Now, we've seen a significant ramp in venture investment in insurtech, even if you adjust for the monster deals, and lots of innovation-type units start up among incumbent insurers." Albarella says. "From the perspective of NYL, there's been tremendous evolution in our culture and thinking about the future and testing new digital techs to make sure we compete well into the future."

Innovation services is a relatively new addition to the unit's portfolio of responsibilities. According to Albarella, that includes working closely with HR to develop employee programs like design-thinking workshops and sprints, as well as a now-annual hackathon. And the innovation lab works closely with the company's technology organization to understand what technologies can be winners, whether that involves a homebrew or partnership.

"[IT] can raise their hand around specific areas they find interesting and we can help them with a build capacity in the lab or we can help with our trusted external network" of companies, Albarella says.

The lab does a new proof-of-concept about every two weeks. To date, most of the successful partnerships have come with more general enterprise technology like data management and analytics tools. But that is changing as more startups come to market with disruptive solutions for insurance processes.

"The big opportunity, in my opinion, is that we're in the very early innings of innovation in the insurance industry," Albarella says. "A lot of the innovation has been on the front end and better user experience. There's definitely an opportunity there."