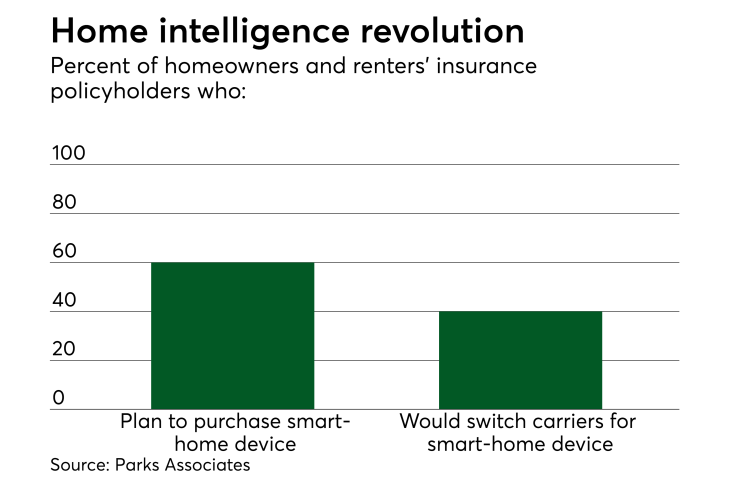

Three in five home and renters’ insurance customers are interested in purchasing a device to install in their home that can detect, prevent or notify homeowners or their insurance company in the event of a loss, according to a report from market research firm Parks Associates.

Parks also found that 40% of customers would switch insurers if the carrier provided such a device, the company reported. Brad Russell, research director for the connected home at Parks Associates, adds that willingness to install a device is correlated with a desire for more value-added services.

“There are multiple go-to-market strategies for … [OEM] and platform partnerships to device rebates, premium discount incentives, and free devices,” Russell comments. “These arrangements have significant benefits to insurers as well, from competitive differentiation to expanded service offerings. The race now for both OEMs and insurers is to develop smart home solutions that can manage the data needs within this industry.”

The Parks survey continues a trend identified in similar research released in the latter half of 2017. In its survey of 172,000 insurance policyholders, Customer Behavior and Loyalty in Insurance: Global Edition 2017, Bain & Co. said an emerging trend among policyholder-insurer relationships is “ecosystem services.”

Bain defines ecosystems as “offering their customers an interconnected array of services that extend beyond insurance.” In home insurance, the company continues, that manifests itself with “emergency repair services, remote monitoring, alerts about intrusion and damage, and automatic shutdowns of appliances during fires and floods.” Home insurers that offered three or more such services had a Net Promoter Score 13 points higher than those with less, Bain reports.

In its Sept. 2017 report, Connected Homes: What Do Homeowners Want From Insurers?, Aite Group defined about a quarter of the more than 2,500 policyholders they surveyed as “connected homeowners.” These customers tended to be younger (77% of them from the Generation X or Millenial Generations) and wealthier (half reported household income over $75,000, compared to 38% of the un-connected customers) than average. One in four connected customers would definitely allow their insurance companies to access the data from them; a further 49% say they would consider it.

“Insurers need to develop multiple value propositions to appeal to the widest range of connected homeowners,” Aite Group’s Gwenn Bezard writes.

He adds that it may not appeal to all carriers, but a centralized approach across the industry may be good for the industry so insurers can benefit from a wide range of data and not be stuck with only a few connected-home partners.

“Insurers need to step up their efforts behind the scenes to ensure their ability to efficiently tap into connected home data for many years to come,” Bezard writes. “For instance, they could join forces to create a blockchain platform dedicated to securely capturing key events from connected personal and commercial devices for security, maintenance, and claims purposes, empowering residential and commercial property owners over their data, and making it easy and cost-effective for the insurance industry to tap into the data to deliver services to their customers and help expedite claims.”