Coterie will be using ZestyAI's property risk analytics platform, Z-Property, to provide risk insights for business insurance underwriting across the U.S., according to a

"Coterie is committed to maintaining a low loss ratio and ZestyAI enables us to reduce time spent underwriting, auditing and pricing while lowering our expense ratio," said Paul Bessire, chief data officer at Coterie Insurance. "Their focus on AI and innovation without losing track of regulatory support, in addition to the breadth, power and speed of delivering detailed property data, make them a dream partner for us."

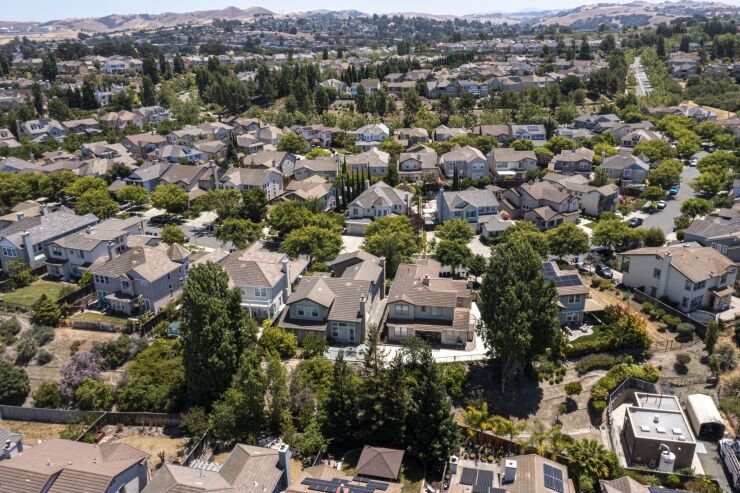

Coterie Insurance seeks to use ZestyAI's precision scoring on factors such as roof condition and complexity, debris, and vegetation overhang to inform its underwriting decisions.

ZestyAI has also partnered with major insurance carriers such as

"Insurance is a tough industry to be in these days," said Atilla Toth, CEO of ZestyAI. "Inflation, increasing catastrophe losses, pressure on premiums, increasing regulatory complexity... you name it. There are so many factors to consider, and not having the right data insights can cost insurers not only a pretty penny but the trust of their customers."

This agreement seeks to solve that potential problem for Coterie Insurance as it expands into the commercial property insurance industry.

"We're thrilled to be supporting their goal of redefining the commercial insurance experience for agents and brokers, partners, and policyholders," Toth said.

ZestyAI's Z-Property platform integrated into Coterie's existing systems in less than a week, the companies said.