How has the digital transformation of the insurance industry shaped up so far for commercial property insurers? A new study finds that they have zeroed-in on applying predictive analytics to improve their underwriting.

The global online survey and follow-up interviews with more than 40 carriers, brokers and insurtechs in the middle-market and large commercial and specialty segments, were conducted earlier this year by EY, the advisory firm. The findings show that while digitalization of the underwriting function is rapidly taking place within the commercial segment, technology deployments have been limited to just a few applications, such as developing pricing models and parsing demographic data.

One reason for this, speculates Gail McGiffin, an EY principal and the study’s author, is that “Underwriting organizations may have a way to go on the cultural front. For example, one reason for the limited applications and narrow use cases is that digital may lack a single unifying vision or leadership sponsor within underwriting.”

For the business value of these technologies to be fully realized, McGiffin says that underwriting needs to work more closely with IT and other partners “to define and prioritize the use cases for these digital technologies.”

Top technologies

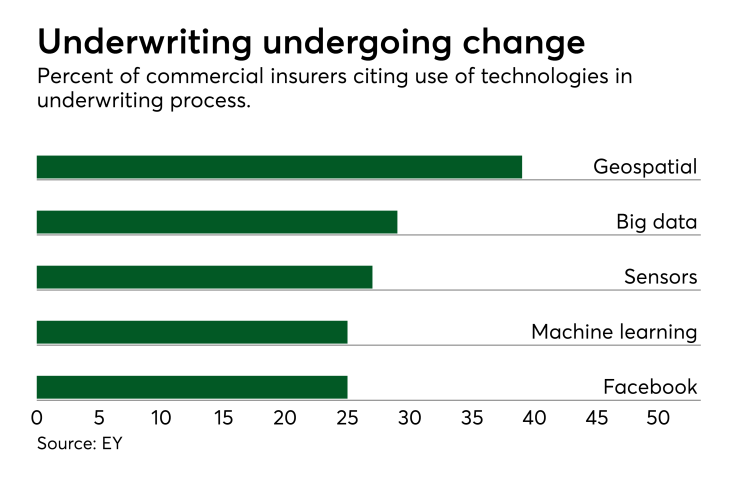

Within underwriting, the technologies most widely used are predictive analytics, followed by big data, underwriting trading platforms and geographic information systems (GIS), according to the study. More than half of the survey respondents say they are currently rolling out or already making use of these technologies, as well as others, including big data, automated portfolio management, machine learning and sensor-based technologies.

Among the study's other key findings:

· Looking ahead, insurers and brokers say underwriting and pricing capabilities are their top priority for future technology investments.

· Blockchain, robotic process automation (RPA) and sensor-based technologies are all high priorities going forward, and insurers are planning to invest heavily in these areas. Some have already undertaken research, proof of concept or pilot programs centered on these technologies.

· To date, predictive analytics and machine learning have been mostly used for actuarial work, while RPA has been mainly utilized for policy processing. Big data and automated portfolio management have primarily been applied to product management.

· Forthcoming investments in blockchain and sensor-based technologies will benefit loss control, while future investments in big data will most likely be geared towards sales, customer service and distribution.

The study makes it clear “that these early stage investments are focused on singular technologies,” McGiffin notes. “We believe that the greatest business value will be achieved as digital technologies are more integrated as solutions supporting business use cases.”

For example, she says, machine learning and artificial intelligence could be used together with predictive modeling to segment renewal account handling.

Asked if there were any surprises in the study and which findings she least expected, McGiffin says that she had hoped to see broader use of big data and predictive models beyond pricing and demographics, but that so far that hasn’t been the case. And given the current level of industry investment in InsurTechs, she adds that “We were surprised that there was not more traction to date by insurers to partner with and license these capabilities.”