Digital transformation has changed many facets of insurance companies, including the roadside assistance experience.

“Customers expect efficient and reliable service and fortunately, technology has evolved quickly during the past few years to provide an experience that is more personalized,” says Dave Powell, vice president of auto claims at Travelers. “Travelers roadside assistance technology partners are pushing the industry in a new direction, taking manual processes and redefining them as digital, transparent and connected.”

The evolution toward a more omnichannel approach, and accessing services remotely, has been happening for several years but COVID-19 has accelerated the on-demand consumer expectations, says Chris Small, vice president of customer experience at

“Having a roadside event is a critical inflection point in a policyholder’s lifecycle,” Small said. “It’s a moment of truth that we want to rally behind and be the hero of.”

Companies like Agero and

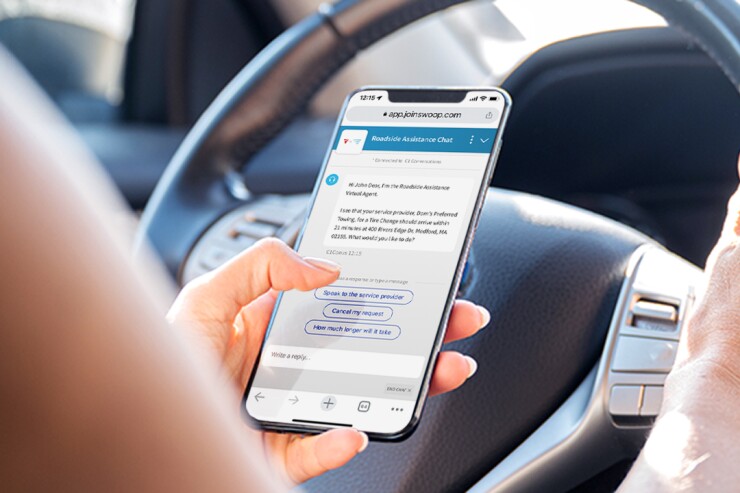

Agero recently released new conversational artificial intelligence tools that create a more efficient roadside assistance experience for consumers. The new virtual chat assistant and conversational voice enhancement feature leverage AI, machine learning and natural language processing for a self-service opportunity. The voice enhancement and virtual chat speed up the roadside assistance process and reduce wait times.

Small said the company has been on a digital transformation journey for a few years and the company is using AI and machine learning technology to do it.

“We have realized that the evolution of the tech around natural language and machine learning and conversational AI has created an opportunity to bring customers an audio-driven experience,” Small said. “For insurers, it creates an additional customer experience that customers are asking for.”

Seven out of the 10 top insurance carriers use Agero to deliver roadside assistance to policyholders, Small added.

HONK is also working to reinvent roadside assistance by putting the customer and towing provider at the center of the interaction.

Paul Williams, the vice president of business development at HONK, said that HONK has developed a platform that connects the best providers to a job.

“If you are the best person to provide a service we will dispatch you,” Williams said. “We have a look at data points and GPS tracking, we send out offers to the network and they can accept if they want. Through tracking and real-time data on driving conditions we can offer accurate arrival times.”

Technology has also led HONK to change how customers request a service, Williams added.

“Typically, when someone breaks down, their learned behavior is to pick up the phone and call someone. With HONK, we deliver a digital experience and digital solutions to provide the same information but without a phone call,” Williams said.

Consumers can still call, if they want to, Williams added, but he said the majority choose digital if given the option.