-

When AI is simply layered on top of policy-centric platforms, batch-based processes, and siloed data models, it inherits their limitations.

February 5 EIS Group

EIS Group -

-

Insurers learned that 2025 was about regaining balance and 2026 will be about redefining value for customers with better data, tools and insights.

February 4 Plymouth Rock Home Assurance Corporation

Plymouth Rock Home Assurance Corporation -

-

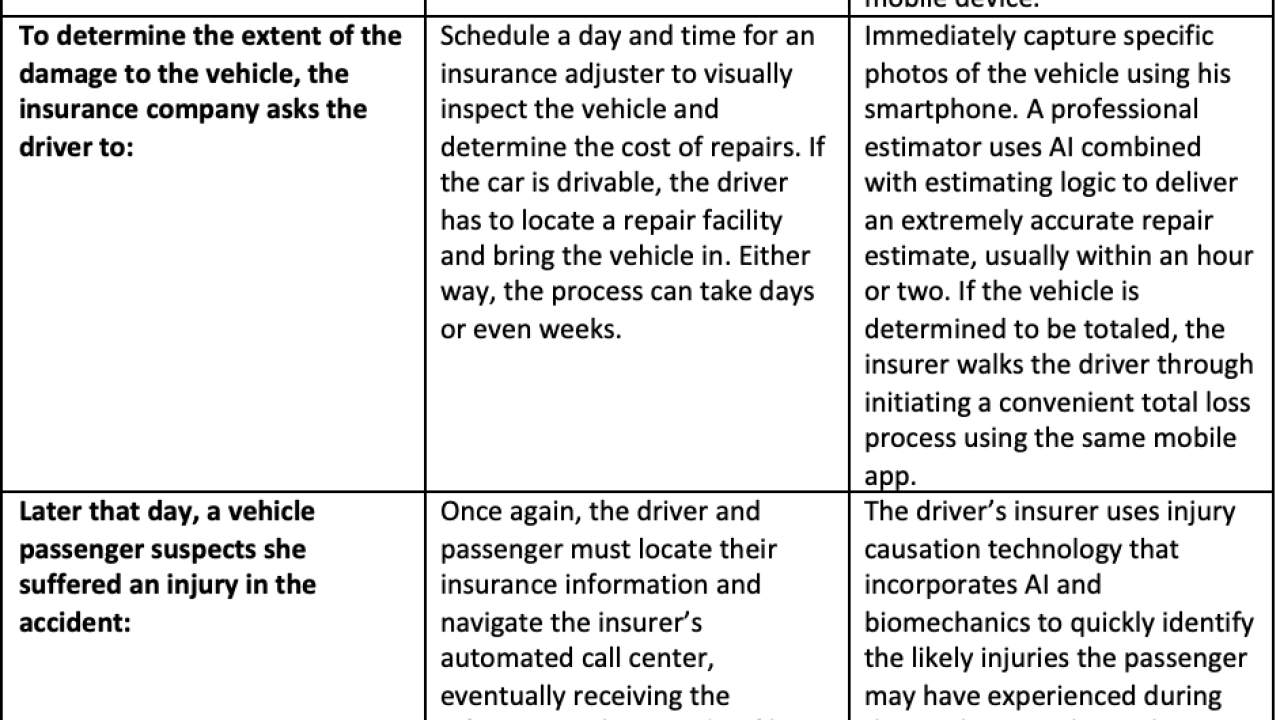

AI is reshaping how claims are handled, how repairs are performed, and how teams deliver faster and more connected experiences across the auto claims ecosystem.

February 4 CCC Intelligent Solutions

CCC Intelligent Solutions -

Insurance companies need more reliable, bottom-up data and more strategic technology partnerships.

February 3 Spektrum Labs

Spektrum Labs -

AI holds enormous potential for small businesses, providing tools that can empower them to do more with less.

February 2 Cooperhawk Business Brokers

Cooperhawk Business Brokers -

Emerging AI capabilities give agencies a clearer, more dynamic view of their entire book of business including underwriting, renewal and service workflows

February 1 Applied Systems

Applied Systems -

Tracking fraud, waste and abuse in healthcare is a challenge, but AI is helping insurers identify it sooner.

January 29 Sigma Software

Sigma Software -

The insurance industry must discard outdated models and embrace new skillsets to survive.

January 26 Simply Business US

Simply Business US -

AI is transforming underwriting and helping to automate different aspects while improving the customer and agent experience.

January 18 Damco Solutions

Damco Solutions -

The most impactful data today is clean, structured, operational data collected across the entire policy lifecycle.

January 14 Novidea

Novidea -

AI impersonation fraud and attempts involving deepfakes have surged by more than 2100% over the last three years.

January 12 Input 1

Input 1 -

Used correctly, AI can help insurers move faster, identify risk more accurately, and reduce costs without replacing human expertise.

January 6

-

A vertical-specific AI can digitize the contextual judgment of retiring experts, helping staff to access "word-of-mouth" wisdom instantly in the correct context.

January 5 Outmarket

Outmarket -

AI will move from the margins and into the fabric of insurance, redefining how carriers do business and streamlining operations for efficiency while optimizing the customer experience.

January 5 INSTANDA

INSTANDA -

Changing communication methods like the use of emojis present a growing compliance risk in regulated industries where interactions are subject to scrutiny.

January 4 Smarsh

Smarsh -

AI agents can reason through complex questions, understand intent, communicate naturally, and handle tasks that used to require a person on the other end of a call.

January 1 ASAPP

ASAPP -

In most agencies, 80% of revenue is generated by only 20% of their accounts, meaning that 80% of an agency's customer base is responsible for only 20% of its revenue.

January 1 ReSource Pro

ReSource Pro -

Insurers can transform AI spending into intelligent capacity investment through several practical steps and strategies.

December 31 LingXi Technology

LingXi Technology -

Enterprises are adopting agentic AI that plans and executes on its own while compounding errors, accountability gaps and cyber risk. Clear safeguards and auditability are critical.

December 30 Information Security Forum

Information Security Forum -

As fraudulent claims evolve, so do the defenses against them. Here are four common fraud claims and how to combat them.

December 30 Pennsylvania Lumbermens Mutual Insurance Company (PLM).

Pennsylvania Lumbermens Mutual Insurance Company (PLM). -

AI may be accelerating and scaling digital crime, but the same underlying technology is poised to advance cybersecurity intelligence and strengthen defenses.

December 29 TransUnion

TransUnion -

Successful risk management pairs AI-driven efficiency with human insight and aligns digital initiatives with strategic business goals.

December 29 CGI

CGI -

How to include empathy and prototyping into change management.

December 28 Crum & Forster

Crum & Forster -

Insurance is constantly evolving and now the focus is on returning to the fundamentals and preparing for future growth.

December 24 Vitesse

Vitesse -

When embedded within a case management framework, Agentic AI can detect subtle anomalies, highlight inconsistencies, and surface patterns traditional systems miss.

December 24 Flowable

Flowable -

Three things brokers can do to retain and grow their client base through M&A transitions.

December 22 Beneration

Beneration -

It's important that managing data enables speed, accountability, and trust at scale.

December 18 Xceedance

Xceedance -

A better approach is to offer communication options intentionally, not reactively.

December 17 Hi Marley

Hi Marley -

Parametric providers can notify policyholders when an event triggers a claim, which can then be processed in days, helping customers get back to business more quickly.

December 11 Adaptive Insurance

Adaptive Insurance -

As more insurers tie credits to connected technologies, monitoring will become a basic expectation rather than an added feature.

December 11 Beagle Services

Beagle Services -

The adoption of AI requires buy-in from all departments and levels, and is a tool that can help insurers manage vast amounts of data more effectively.

December 10 NFP

NFP -

New technologies are helping insurers practice ESG principles in a real and meaningful way.

December 8 LendingTree

LendingTree -

The next evolution of AI in insurance involves capturing and amplifying the human behavioral intelligence that differentiates between good and great risk assessment.

December 7 Cowbell

Cowbell -

The trends include cybersecurity, a new digital workforce and strategic growth through transformation.

December 4 KPMG

KPMG -

Without federal oversight establishing uniform standards for AI use or data privacy protection, individual states have created their own rules.

November 25 Archive360

Archive360 -

TPAs are adopting intelligent digital solutions for data extraction, transaction processing and compliance, for higher accuracy and better use of employees' time

November 25 Capco US Insurance Practice

Capco US Insurance Practice -

Global challenges demand coordinated international action and smarter regulation.

November 23 AXA Group

AXA Group -

Insurance has always been about helping people survive the unexpected and that survival has never been more vital and complex.

November 23 Plymouth Rock Home Assurance Corporation

Plymouth Rock Home Assurance Corporation -

Breaches are a matter of when, not if they will occur, and businesses can take key steps to mitigate their risk.

November 20 Amwins

Amwins -

Insurance companies must take a fresh look at the billing and payments experience.

November 20 InvoiceCloud

InvoiceCloud -

The first time a significant catastrophe occurs, it's a black swan, and then it becomes part of the operating environment for risk management.

November 19 WNS, part of Capgemini

WNS, part of Capgemini -

Collaboration is vital in technology adoption with IT providing the technical depth and infrastructure expertise, while operations defines the outcomes that matter.

November 17 Input 1

Input 1 -

Today's emerging technology trends have given way to a measured approach focused on compliance and sustainability.

November 16 Amwins

Amwins -

Vendors should focus on integration, interoperability and reliability.

November 13Cytora -

Insurance companies must rethink legacy processes and embrace technology.

November 13 Hippo

Hippo -

Life insurance should continue to evolve by adding flexibility, accessibility and immediate value.

November 6 Boston Mutual Life Insurance

Boston Mutual Life Insurance -

Climate change costs are increasing and insurance is not keeping pace, so some assets could become uninsurable over time.

November 3 Global Risk Consultants

Global Risk Consultants -

Behavioral science offers solutions to aid in customer comprehension of life insurance.

November 2 Society of Actuaries Research Institute

Society of Actuaries Research Institute -

Insurers should adopt a customer-first strategy that fuses high-tech tools with high-touch engagement.

October 30FECUND Software Services. -

How to build a more resilient and efficient CAT playbook through communication automation.

October 28 Hi Marley

Hi Marley