Insurers are no stranger to large-scale technology changes, but 2020 was unique in the magnitude of change. Incumbent carriers have spent much of 2020 year moving complex IT infrastructures into the cloud and instituting new remote risk assessment technologies, in order to continue serving their customers safely and efficiently.

While individual lines of P&C insurance have experienced differential impact from COVID, carriers generally appear to be coming through the pandemic with their financial health intact, as well as an enhanced appetite for digitization. Personal Auto has become more profitable due to less overall miles driven, Business Owners’ Policies (BOP) are navigating potential litigation regarding business interruption, whereas homeowners’ insurance has seen a relatively muted impact. Overall, carriers have been compelled to accelerate certain digitization initiatives, and have managed them relatively effectively, resulting in an accelerated motivation and increased confidence in their need and desire to adopt emerging digitization technologies.

As carriers rapidly increase their comfort level with digitization, what emerges is an increasingly mounting need to sift the mounting piles of available data for actionable insights, in other words: finding more needles, not creating more haystacks. With that backdrop in mind, here are six predictions for how homeowners and commercial property insurers will think about and implement automation and AI solutions in 2021:

- Carriers will continue organizational investments into underwriting automation and straight-through processing. This trend started a few years ago, but COVID was a real shot-in-the-arm. In the short-term, carriers are looking for “easy” implementations or “enterprise” solutions for quicker internal wins. But as data consumption architectures continue to mature and the potential for automated processes become clearer, we are seeing more complex implementations take hold. Often, with increased complexity comes a need for increased clarity. As such, carriers will increase their reliance on curated, highly predictive information to power these processes.

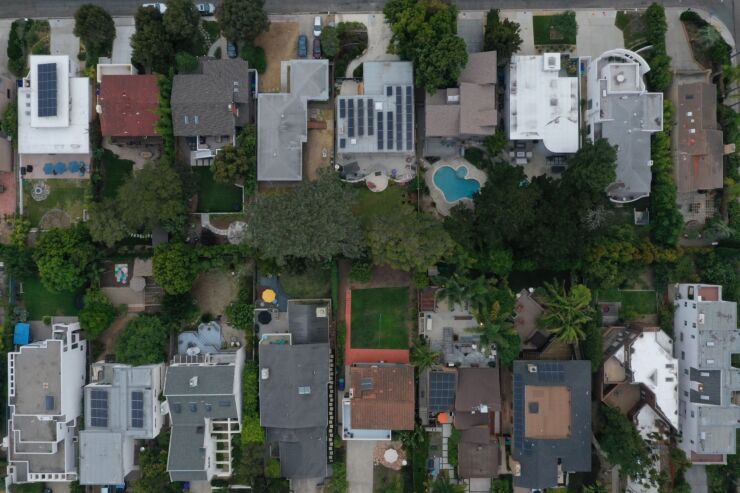

- Automated, remote risk assessment is having its moment: Imagery-based property analytics solutions have ‘crossed the chasm’ and are moving from validation to expansion. This includes expanding geographically from select states to regional or national books of business, and an expansion of use cases, from easy-to-implement book analysis (identifying high-risk policies), to time-of-quote data integrations, and automated change detection for smarter renewals. In addition, the imagery space is heating up, with ever more entrants and resolution options. Remote risk assessment tools and property analytics that make use of imagery will only improve in terms of coverage, recency, and accuracy and will help carriers narrow down the in-force policies or submissions that most urgently need manual action or review.

- AI-powered wildfire solutions will be critical: 2020 wasn’t all rosy for property insurers. Namely, CAT events—including a record number of named hurricanes, and a record for acres burned in California—carved out losses. The newest AI tools can not only quantify regional risk and hazard, but property-specific vulnerability, such as property vegetation coverage. Understanding the actual impact of specific risk mitigation options, like clearing that brush, can be the common ground upon which insurers, DOIs, homeowners, and consumer advocacy groups can come together to fight the growing threat of wildfires across the western U.S. For carriers, these technologies will allow for more granular and transparent risk mitigation, selection, and pricing.

- AI-enabled pre-underwriting is coming: I wrote about

pre-underwriting last year, and we’ve seen a number of insurtechs and MGAs look to test this new, proactive approach in 2021. With more accurate, predictive property data available through geospatial data providers, carriers can look across states, regions, or even the entire U.S. to pinpoint the risks that align most closely to their eligibility guidelines, build a target list of hundreds of thousands of homes, and then chase down the exact type of business they want. It may be more expensive at the top of the funnel, but loss ratios can be more finely engineered over the course of a policy lifecycle. - Self-inspection solutions continue to make gains in claims management: 2020 elevated self-inspection solutions as another option in the inspection toolkit. Now, it’s becoming a more crowded field as self-inspection companies, which leverage computer vision, vie for big insurance customers. Recent funding rounds, including additional funding to Flyreel and Hover, from the likes of State Farm, Travelers, and Guidewire, show how this space is really heating up. So how are they standing apart? By bringing insurance-specific experts in-house and making sure they’re building solutions relevant to specific insurance use cases, like claims, to ensure they’re delivering impactful data.

- Commercial property insurance is getting the AI spotlight: If the 2000s were the decade for auto carrier innovation and the 2010s saw technological leaps in home insurance, then the 2020s will be the era of commercial property innovation. Already, leading insurers like The Hartford and Chubb are actively operationalizing new data sources and technologies in commercial lines. Digital MGAs like Attune and Embroker are making waves with broker and insured-friendly interfaces and automated straight-through workflows. Finally, providers like Bold Penguin and Chisel AI are building exchanges and AI-enhanced automation for underwriting.

So what do these six trends have in common? In 2021, carriers will look for more AI needles and fewer data haystacks. Carriers don’t want another massive trove of data to sift through. Machine learning can help identify the needles—those critical data points like roof condition or vegetation density—that predict loss. It’s these risk-aligned data signals, in addition to their thoughtful implementation, that help carriers make better decisions, faster. An additional innovation that comes with AI-driven data are confidence scores, which provide granularity around the reliability or uncertainty of a specific data point. The most data-forward carriers will dive deeper into these nuances in 2021, into a world where data is not discretely right or wrong and where an understanding of these gray areas can unlock powerful, new decision-making capabilities.

Now, more than ever, homeowners and commercial insurers are looking for pinpoint AI solutions that deliver specific value, for specific business lines, and integrate into workflows in a way that makes sense for their unique approach to offering insurance. Whether that’s a mass market, top of the funnel approach with highly automated straight-through processing; or accepting a larger proportion of policies and dealing with issues on the back end with increasingly advanced claims adjustment solutions; or driving hyper-targeted marketing with pre-underwriting—in 2021 there are powerful AI options for every kind of carrier and every approach... with the insurer appetite for innovation to match.